In recent decades, China has experienced rapid economic development, and both citizens and foreigners working in China have witnessed growth in their salaries. With the enhancement of the taxation system and the improvement of income tax framework, a series of new changes regarding China individual income tax regulations are now in place. In this blog, we will tell you everything about the individual income tax. You can also read about the personal income tax deduction implemented in recent years to see how much you can save!

What Are the Individual Income Tax Deductions?

In order to relieve the tax burden placed, there are 7 categories of 'special additional deduction items' nowadays, summarized in the table below:

| Deduction Item | Deduction Amount (RMB) | Qualifying Requirements | Who can Claim? | When to Claim? | |

|

Previous Standard (before 1st Jan. 2023) |

Latest Standard (after 1st Jan. 2023) |

||||

| Educational Costs for Children |

1000 per child per month |

2000 per child per month | Children’s pre-school, compulsory, intermediate and higher education. |

Even split between two parents, or fully deduction by one parent |

From the month when the children are over 3 years old to the end of full-time education. |

|

Continuing Education Expenses |

400 per month + 3600 (one-time) |

No change |

Formal education in China and professional training |

Individual taxpayer |

From the month of enrollment to the end of education, up to 48 months. An additional 3600 RMB amount is given in the year of obtaining certificate. |

|

Healthcare Costs for Major Diseases |

Actual expense up to 80000 |

No change |

Medical expenses with self-payment over 15000 over medical insurance |

Individual taxpayer OR his/her spouse. Minor children’s expense can be claimed by parents. |

The year when the medical expense occurs. |

|

House rental |

|

No change |

No property in the city of employment. Can not be enjoyed with housing loan interest deduction at the same time. |

Taxpayer OR his/her spouse (if joint rental). |

During the actual period of lease term. |

|

Housing Loan Interest |

1000 per month |

No change |

The FIRST property only. Can not be enjoyed with house rental deduction at the same time. |

Taxpayer OR his/her spouse (if joint owned). Could be even split between the couple, or fully deducted by one of them (if the property is purchased before marriage). |

During the actual period of mortgage taking with a maximum limit to 240 months. |

|

Elderly Support |

2000 per month |

3000 per month |

Parents or other obligations by law are over 60 years. |

Individual taxpayers. Can be split between siblings with maximum claim amount of 1500 per month. |

From the month of parents’ aging 60 years old to the end of year of terminating supporting obligation. |

|

Infant Nursing (Implemented from 1st Jan. 2022) |

1000 per month |

2000 per month |

Infants under 3 years old. |

Even split between two parents, or fully deduction by one parent |

From the month of birth to the month of reaching 3 years old. |

The increase in the special additional deduction amount for personal income tax will significantly lead to the increase of people’s disposable income, and promote domestic consumption capability by reducing the tax burden, especially for the low- and medium-income families, helping boost the residents’ consumption. From the social level, these updates will improve people’s consumption expectations and better drive the social and economic development.

What Are the Reimbursement for Foreign Individuals?

On August 18, 2023, the Ministry of Commerce (MOF) and State Taxation Administration (STA) jointly published the ‘Announcement on the Continuation of Implementation of Individual Income Tax Preferential Policies Such as for Foreign Nationals’ Benefits’, Which extended the preferential tax exemption policy for extra 4 years to December 31, 2027. The extension surely brings advantages and immediate relief to foreigners working in China who carry a heavy burden on educating their children by their monthly salary by taking out the expenses of the following categories from taxable amount.

|

Item |

Deduction amount |

End of deduction period |

|

Housing rental |

Reasonable actual expense amount with invoices or receipts | 31st December 2027 |

|

Children’s education expense |

||

|

Domestic and international business travel expense |

||

|

Language training expense |

||

|

Laundry cost |

||

|

Relocation expense |

||

|

Food and meal expense |

||

|

Home leave expense |

In addition, dividends and bonus income received by foreign individuals from foreign-invested enterprises are exempt from personal income tax. This policy is a further encouragement for foreign investors, showing China’s strong willingness to attract foreign investment and the nation’s confidence in its future market development.

The extension of the preferential policy of subsidies for foreign personal allowances to 2027 optimizes the foreign investment environment and increases the attraction of foreign investment. Focusing on outstanding issues in the business environment that foreign-funded enterprises are concerned about, the State Council has also proposed a new batch of highly targeted and valuable policies. High-level policies and measures to stabilize foreign investment will more effectively boost foreign investment confidence and attract more high-quality foreign investment.

How Should I Pay Tax for My Annual One-time Bonuses?

On 18th August 2023, the Ministry of Finance and the State Taxation Administration announced to expand the implementation period of ‘the Notice of the State Administration of Taxation on Adjusting the Methods for Calculating and Collecting Personal Income Tax on Individuals Obtaining One-time Annual Bonuses and Other Issues’, which regulates the tax payment of the annual one-time bonuses, to the end of 2027.

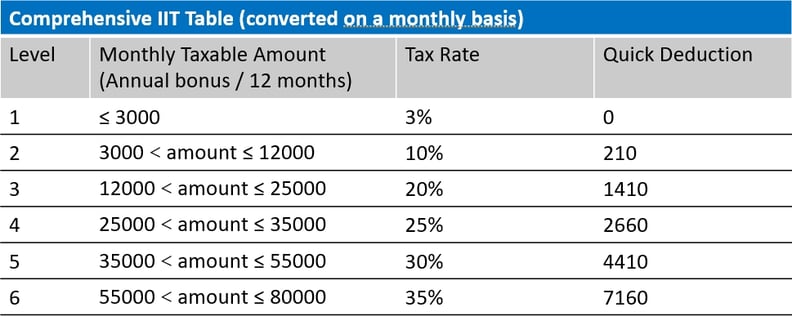

According to the Notice, the one-time bonus received by resident individuals will not be incorporated into the comprehensive income of the year. The one-time bonus amount divided by 12 months will be used to determine the applicable tax rate. The calculation of your annual one-time bonus tax is:

- Tax payable on annual bonus = Monthly-converted bonus amount x Applicable tax rate – Quick deduction

where the tax rate and quick deduction amount are as below:

Conclusion

Careful planning and choice-making can surely help you save money with the benefits of preferential tax policies. If you want to more information about the tax system in China, you will welcome to contact Hongda for more information. And if you are running a company in China and expecting to work with the right partner for your employees’ payroll services, Hongda is just the one you are looking for! Simply book a free consultation with our experts and let us advice the best tax payment system for both you and your employees!