When starting a business in China there are any laws and responsibilities for business owners that may be new and unfamiliar.

Not only will the language barrier be a problem, but China simply does things very differently to the rest of the world in many case.

Today let's discuss China social insurance, what it is, who pays what, and how you can handle it...

What Is China Social Insurance?

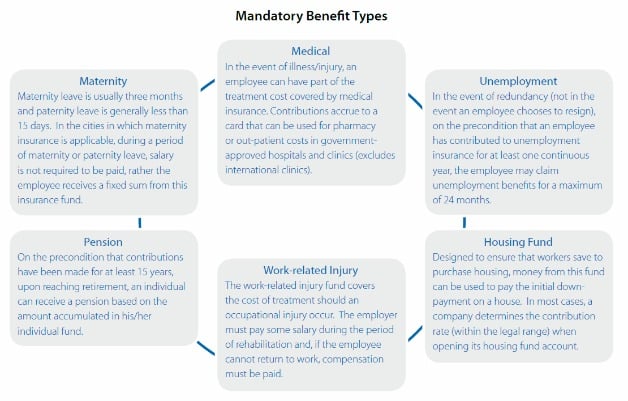

China social insurance covers pension, unemployment, health care, work-related injuries, and maternity leave.

It is paid by both employer and employee, and the levels od this payment to the social insurance agencies are connected directly to the employee's salary.

It can be complicated as there is not one steadfast rule for the country. Instead it is governed at a regional level, so depending where your company is based in China you will have differing responsibilities as an employer.

Here are the insurance types in some greater detail:

All local staff will need to be registered for social insurance, and this then covers their employment and makes sure that your China company is compliant.

Do Foreign Staff Require Social Insurance Too?

Yes. Since October 15th 2011, all foreign workers working legally in China are also required to make social insurance payments based on their salaries.

The procedure to register them is a little different to that of local staff, but essentially foreign staff will now be given a Chinese social insurance number and make monthly payments into the above social insurance types.

Even if they have personal insurance schemes abroad, they will still be required to pay Chinese social insurance.

How Do We Handle Paying Social Insurance After Starting A Business In China?

Firstly, you're going to need local Chinese speakers who are familiar with this procedure to help you as you will need to deal with several government departments.

Generally the procedure follows this path:

1. Register employees’ social welfare accounts

Go to your local Social Insurance Management Center to set up an account for your company. There should be one in each district of major cities.

In the PRD you can find them here:

- Guangzhou social insurance management center

- Shenzhen social insurance management center

You will need the following documents to set up the account:

- The original copy of your company’s business license, and a photocopy

- The original copy of your company’s organization code certificate, and a photocopy

- A stamp by your company chop

- Company Registration Form of Social Insurance; you can get this at the center

- The company bank account number

- The company’s tax registration number

- A commitment letter of use social insurance card signed, which you can obtain at the center

Following this you will be able to legally hire local Chinese staff.

2. Registering your employees onto the employment record

Next, you need go to the local Human Resource and Social Security Bureau to register your employees onto the employment record.

- Guangzhou human resource and social security bureau

- Shenzhen human resource and social security bureau

You will need the following documents:

- The original copy of your company’s business license, and a photocopy

- The original copy of your company’s organization code certificate, and a photocopy

- Your company’s official “chop” (aka stamp or seal)

- Completed registration form of employment record with your new employees’ names and a brief introduction of each of them. You can get this in the bureau and it should be completed in triplicate; one should be submitted with the above documents at the Human Resource and Social Security Bureau, one copy should be submitted when you return to the Social Insurance Management Center (see below), and one should be kept for your company’s files.

3. Registering the employees

Now you must actually register your specific employees. You will only need to do the above two procedures the first time you employ a Chinese person; the following procedure applies for each Chinese person you hire from then on. Return to the Social Insurance Management Center with the following documents to register the employee (or, if they already have a social insurance card, use the following documents to change their employer’s information to your company).

- Company Registration Form of Social Insurance

- Employee Personal Information Registration Form; you can get this at the talent center in the district where the company is registered. Click here for Guangzhou talent centers, and here for Shenzhen talent centers.

- A list of all the employees at your company

- The original copy of your company’s business license, and a photocopy

- The original copy of your local tax registration certificate, and a photocopy

- A spreadsheet showing how much your employees are paid, how much is paid into their insurance and housing fund, and any bonuses they have been paid

- Photocopy of insured employees’ ID cards

It takes about two months to get the new employee’s social insurance card ready, but they can begin working straight away and you will need to start paying into their social security account from their very first paycheck.

Registering your employees with the housing fund

You can do this at any point in the process outlined above, or afterward. Go to the local Public Housing Fund Management Center to set up a housing fund account.

You will need the following documents, and it will take approximately five working days to process:

- Public Housing Fund Deposit Form, which you can get at the center

- Your company’s business license and a photocopy

- Your company’s organization code certificate and a photocopy

Once the account is set up, you can place your employees’ personal accounts under your company account. The documents needed to do this are:

- Personal Housing Fund Account Set-up Form, which you can get at the center

- A photocopy of the employee’s ID card

As you can see, this will require much paperwork and dealing with local government employees, but is an essential step for anyone who is opening a Chinese company, such as a China WFOE.

Who Pays What?

- Pension: Employer pays around 20% of employee salary, employee pays around 8%.

- Work related injury insurance: Employer pays 0.4 to 3% of employee salary, and employee is not required to contribute.

- Medical insurance: Employer pays around between 7 to 12% of employee salary, and employee pays around 2%.

- Maternity cover: Employer pays around 0.5 to 1% of employee salary, and employee is not required to contribute.

- Unemployment insurance: Employer pays around 2%of employee salary, and employee pays around 1%.

- Housing fund: Employer pays around 7 to 12% of employee salary, and employee pays around the same.

Conclusion

As an employer running a business in China you are liable to offer the benefits discussed in this article to your local and foreign employees.

Whilst it may be possible to set up the systems without help by going to the relevant government departments, they are complex, time-consuming and require an excellent grasp of Mandarin Chinese.

Because the China social insurance not only needs to be set up, but also paid monthly, it may be easier to outsource this task to the local experts at Hongda Business Services.

You'll gain:

- More time to spend on doing business

- Peace of mind that your company is compliant

- Expert partners who understand the system and can offer feedback and advice in plain English

Are you currently running a Chinese company? How do you deal with social insurance and other obligations? Do you have any advice for our community?

Please leave a comment below to share your opinions.