%20declaration%20and%20apply%20for%20a%20rebate%20in%20China_.jpeg?width=1200&name=How%20to%20make%20your%20Individual%20Income%20Tax%20(IIT)%20declaration%20and%20apply%20for%20a%20rebate%20in%20China_.jpeg)

If you’re an expat who is working in China, or will be soon, the bad news is that you will probably need to pay Individual Income Tax (IIT), but the good news is that you are likely to be entitled to some tax exemptions or a rebate.

No one likes paying tax, but being able to get something back makes it easier!

So, in this blog post we’ll remind you about the basics of IIT, show you the process required to make your tax declaration, and some information on exemptions and rebates.

What is Individual Income Tax (IIT) in China?

Since 2019 China taxes foreigners who reside in the country for 183 days per year or more on their income as they are considered a ‘resident’ for tax purposes.

The IIT law uses a progressive tax rate scale which, in general, can be a little kinder to low and middle earners.

It also includes a number of tax deductibles that can be claimed, for both foreign and domestic workers, which can also help ease one’s tax burden, including:

- Further education costs

- Children’s education costs

- Rent

- The cost of care for elderly family members

- Medical expenses for serious illnesses

- Mortgage interest

Dividends and bonuses paid to foreigners from a WFOE are also exempt from IIT, which is good news for foreign directors and staff.

Who does IIT law affect?

Foreign workers will be expected to pay IIT regardless of whether they work for a Chinese or foreign company if they are classed as a resident or, in some cases, on income derived directly in China for non-residents.

What if I am not in China for long periods?

For many foreign staff who work in trading, manufacturing, consulting, etc, it is not unusual to spend a month or two in China at a time and then the rest of the year elsewhere.

In general, you will not be liable to pay IIT if:

- You spend fewer than 183 days in China

- Your country has a double-taxation agreement with China (most do)

- You are employed by a non-Chinese company

- You are paid abroad and not in China

The work you do is not directly responsible for deriving income from China

You may need to fill out a declaration form to show the authorities that you are not a resident or non-resident tax payer.

Learn more about the basics of Chinese Individual Income Tax

You should read these posts to learn more about IIT, who it affects, and the tax rate scale:

- [Infographic] China Individual Income Tax: What Expats Need to Know! - this infographic is a good starting point as it explains the basics that you need to know about IIT.

- China's IIT Reform: 3 Major Changes for Foreigners in 2019 - explore the three key changes for expats working in China, such as the definition of who is a resident, the new tax deductibles, and the tax rate changes.

- How to Calculate IIT: Foreign Expats Between China and Hong Kong - in this post some examples are given of the IIT calculations required for expats who work in Hong Kong and China (a common scenario).

Before we get on to exemptions and rebates, let’s look at making the IIT declaration...

Times when a self-declaration for IIT is needed

Some workers (Chinese or foreign) in China may need to make a self-declaration for IIT, these include:

- The Filing of Returns of Individual Income Tax on Comprehensive Income on a Consolidated Basis

- The amount of income is taxable but without a withholder for the taxes that should be paid

- The amount of income is taxable but the withholder of the tax payment fails to set aside the payment according to related regulations.

- When you received income from abroad

- When you give up Chinese nationality for moving abroad

- Taxpayers that are non-Chinese citizens who receive salary or payments from two or more sources

- The prepaid amount of tax is lower than the actual taxable amount during one tax year

- When the taxpayer applies for an individual tax rebate

What information is required to make the IIT declaration?

- Name

- ID number (Chinese citizens)

- Chinese mobile phone number - as authentication codes will be messaged to you

- Proof of total income (salary information/payslips)

- Special deduction information (see above about tax deductibles)

- Shibao/social security and provident fund

When can you make the IIT declaration?

This should be made between March 1st to June 30th each year.

How to make the declaration

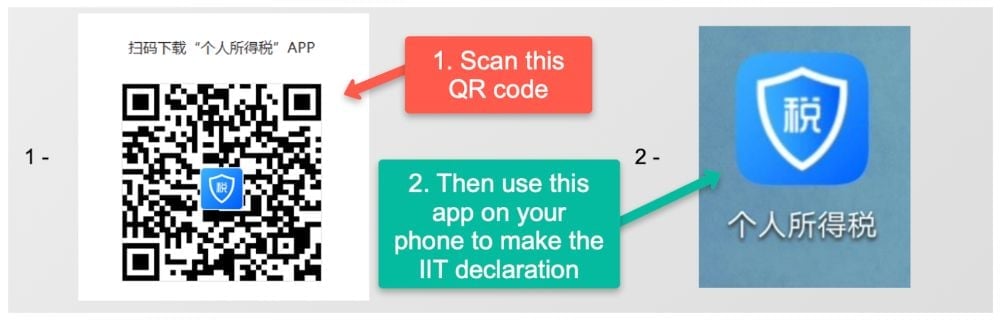

The national tax bureau provides this mobile app which you will use to make your declaration:

Please note that the app is totally in Chinese, so you may need some assistance, however it is convenient.

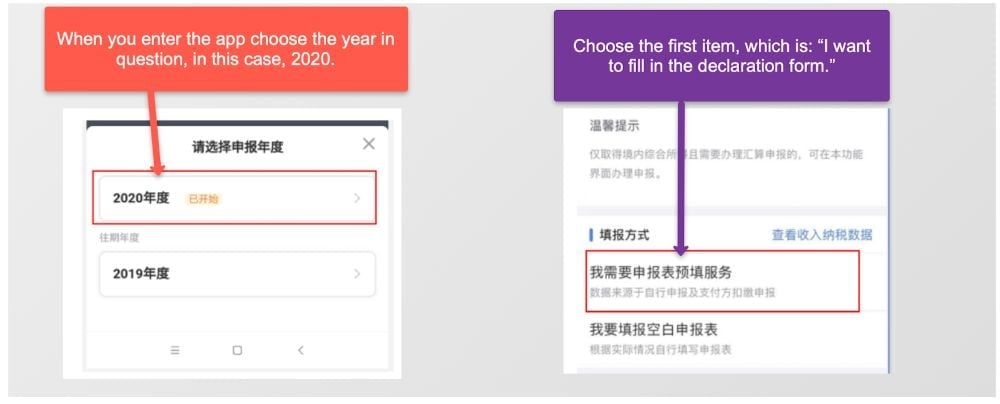

Once you are in the app you need to make these selections to fill out your declaration:

How to apply for tax treaty benefits or a rebate?

There are a number of forms for different purposes you can fill where you can select self-declaration, withholding declaration, or rebate. These will be used when applying for a rebate, for example.

They are:

- For individuals

- Tax treaty benefits under articles of dividends, royalties, and interest

- Tax treaty benefits under articles of permanent establishment and business profits, or independent personal services

- Tax treaty benefits under articles of capital gains or other income

- Tax treaty benefits under articles of dependent personal services, artists and sportsmen, pensions, government service, teachers and researchers, students, or treaty benefits under international transport agreement

You’ll fill this if you’re a qualified non-resident taxpayer (for example if your country has a double taxation agreement with China).

You will also fill it to claim tax treaty benefits or if you’re a foreign expert who fits into these categories where your salary or wages are also exempt, such as if you are:

- Sent by the world bank to work in China

- Sent by the UN

- Working on UN assistance projects

- An expert sent by a donor country to work on the country’s free assistance projects

- A cultural or educational expert working in China for less than 2 years on a government exchange program who are paid in their own countries

- A cultural or educational expert working in China for less than 2 years on an international educational exchange program with Chinese colleges or universities who are paid in their own countries

- An expert working in China through non-governmental research agreements who are paid in their countries

Need help with your IIT declaration or to apply for exemptions or a rebate?

All of the forms and apps can be hard to navigate for foreigners working in China or with businesses here.

You may be paying IIT and unaware that you are able to claim back some of the tax!

If you are unsure about how to proceed, we can help! Contact us to discuss making your IIT declaration and investigating if you're eligible for exemptions or a rebate.