Having opened your Chinese company you're now able to operate locally and start doing business here.

That's great news, but foreign businesses also need to be aware of which China taxes they should be paying, and their obligations towards paying China social insurance for their employees.

While it is getting easier to start a business here, the intricacies of China accounting laws and procedures can still be hard to grasp for overseas companies. After all, they're often quite different.

The purpose of this blog post is to introduce China taxes and China social insurance in simple terms so you're able to get ahead of what you're obligated to do, and run a compliant business in China. You may also enjoy our FREE eBook "China accounting: An introductory guide for foreign companies" which sheds even more light on every aspect of accounting in China which is likely to affect foreign companies like yours...

China Accounting Laws Affect Your Company

Foreign companies running a WFOE, JV, or rep office naturally come under scrutiny in China in the same way that local companies are policed.

Just because China is a large developing country doesn't mean that they don't have rules and regulations in place to protect their economy and workforce.

So an essential part of China company setup for foreign businesses is to make sure that your accounting system is watertight as soon as you start operating.

When everything is in Chinese it's easier to make mistakes, especially when you're relying on others to handle your accounting (unless of course you are an expert in accounting here, in which case that's useful for you).

While an accounting snafu is unlikely to be serious, left unchecked your company could run into problems down the line when being audited.

A simple way to avoid these kinds of issues is to have a grasp of which tax and social insurance obligations companies have in China.

Individual Income Tax (IIT)

All employees must pay IIT each month, and this is one of the China taxes which falls on their shoulders alone. However, as employer you (or your accountant) must make the deduction and then submit it to the local tax authority.

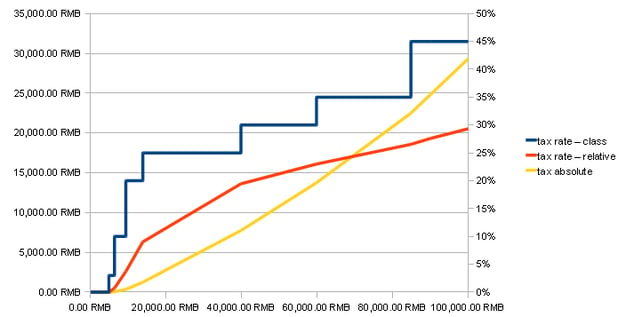

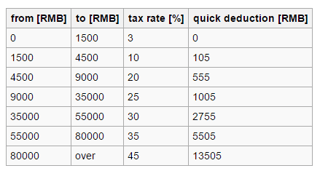

The tax rate for employees is set at 7 different levels from 3% up to 45%.

Image source: Wikipedia

The tax exemption is pegged at 3,500 RMB for local employees and 4,800 RMB non residents (foreign staff).

Therefore, to calculate their IIT we follow this equation:

monthly tax = (taxable income - tax exemption) * tax rate - quick deduction

Please note that IIT rates are subject to change, so please check with your accountant to make sure that there are no new changes before performing calculations.

China Social Insurance / Security

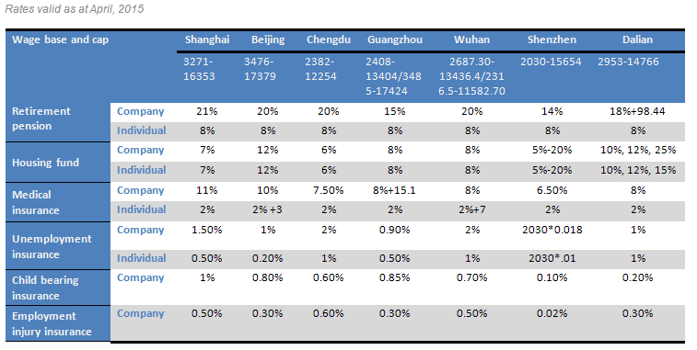

Employers and employees must contribute to China social insurance for both local and foreign staff, but only Chinese staff must have the housing fund contribution.

China's social insurance includes the following:

- Medical insurance

- Pension

- Unemployment insurance

- Industrial injury cover

- Maternity leave cover

The contributions are broken down in the following table:

Table courtesy of SJGrand

Please note that social insurance rates are subject to change and that the information above is only to be used as a guide. Your accountant will be able to confirm current rates in your city or region.

While employer and employee may be obligated to pay different percentages of contributions, the employer will make the entire payment to the local authorities, deducting the employee's contribution from their gross salary.

Employers will coordinate payments with the local Ministry of Human Resources and Social Security of China (MHRSS).

It is also important to note that foreign staff must usually be registered for social insurance, but upon the end of their contract they will be entitled to 'cash out' their unused social insurance contributions.

>> Tweet this information to your network <<

China Housing Fund

The China housing fund is an equal contribution between employer and employee, and is a way for staff to save money towards the purchase of their own home.

This interesting benefit builds up a 'pot' of money where the balance may only be withdrawn for a deposit, purchase, construction, or renovation of a house; and also to pay off a mortgage, or for certain emergency situations such as urgent costly medical treatment.

When employees retire, if they have not yet used the fund they may withdraw it and use it for any reason that they wish.

After setting up your company you will need HR to go to the local Housing Fund Bureau and register your business's details with them in order to be authorised to automatically pay the contributions.

Conclusion

Foreign companies, no matter whether you have a WFOE in China or a joint venture, must be aware of their financial obligations regarding China taxes and social insurance, as well as that of their employees too.

Typically you will need to calculate the monthly tax and insurance payments based on your city's regulations, and whether your staff member is a foreigner or a local. You will also need to make the entire payment (both yours and your employee's contributions) to the local authorities.

You can actually go one step further and grab your FREE copy of our comprehensive eBook: "China accounting: An introductory guide for foreign companies" by following the link. This breaks down the accounting issues that you're likely to encounter when starting a business in China and then subsequently seeking to run it in a compliant manner into plain English.

Are you currently running a business in China, or planning on doing so soon? Where, and which industry?

What are the accounting issues that you have faced when doing business here? How did you overcome them?

Do you have your own in-house accountant in China, or do you outsource?

Please share any experiences, questions, or comments that you may have for our community by leaving them as a comment at the bottom of the page, and we will answer them as fast as possible.